Unemployment Rate and Nonfarm Payrolls Both Rise: What Is Going On in the Labor Market?

The latest BLS report reveals unusual job and unemployment trends. See what this mixed labor market means for workforce planning in 2025.

On November 20, 2025, the Bureau of Labor Statistics (BLS) released labor market data that had been delayed by the recent U.S. government shutdown. The report offered long-awaited clarity on economic conditions, but it also created confusion for many observers.

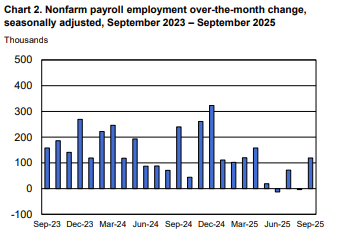

According to the BLS, total nonfarm payroll employment increased by 119,000 in September, beating expectations by roughly 69,000 jobs.

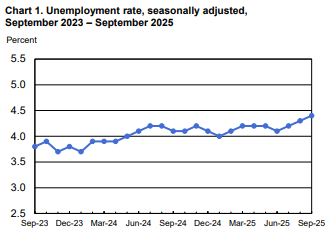

At the same time, the unemployment rate edged up to 4.4 percent from 4.3 percent.

While the rise is modest, it is notable because these two indicators typically move in opposite directions. When payrolls grow, unemployment usually falls. This month’s data breaks that pattern, prompting questions about what is actually happening in the labor market.

One reason these indicators can rise at the same time is a change in labor force participation. When more people enter or reenter the labor market, the number of individuals counted as unemployed can increase even if employers are still adding jobs. The household survey data reflects this dynamic. More workers began actively looking for jobs in September, expanding the pool of job seekers faster than employers added positions. In other words, unemployment can rise even in a growing economy if job creation does not keep pace with new entrants.

Another factor shaping this mixed report is how uneven job growth has become across industries. September’s gains were concentrated in health care, food services, and social assistance, while other sectors, including transportation and warehousing, lost jobs. This imbalance can make the overall labor market appear stronger than it feels for certain categories of workers. For HR teams, this means candidate availability and competition will vary widely depending on role type, industry, and required skills.

Wage data also reflects a cooling but still active labor market. Average hourly earnings increased by 0.2 percent in September, a modest rise that suggests wage pressures are stabilizing after several years of strong growth. For employers, this creates an opportunity to revisit compensation strategies, especially for hard-to-fill roles, while still maintaining cost discipline.

For HR and People Operations leaders, the takeaway is that this is neither a hot nor a weak labor market. It is a transitional one. Employers are still hiring, but more cautiously. Workers are returning to the job market, but not always finding immediate placement. Job growth is real, but uneven. And wages are rising, but at a slower pace.

This environment requires a nuanced approach to workforce planning. Recruiting teams should be ready for an increase in applicant volume, but they should also prepare for continued competition in specialized fields. Compensation teams should monitor wage trends to stay aligned with the market without making unnecessary broad increases. And leadership should prioritize retention, development, and internal mobility as employees weigh new opportunities in a shifting economic landscape.

The September report ultimately reflects a labor market adjusting to post-shutdown uncertainty and evolving economic conditions. By understanding the forces behind the data, HR teams can make more informed decisions as they plan for the months ahead.

Like this article? Subscribe to PeopleBrief to stay up to date on new articles, tools, and insights.